Equity Income Fund (EIF)

Fund Objective

The main objective of the fund is to generate returns from the share market whilst also actively preserving capital through fixed income investments. The dynamic allocation strategy will allow investors to benefit from the share market whilst reducing losses in a down market cycle.

Key Benefits

Start with a small investment as low as LKR 1,000/-

Withdraw anytime

Manage your investment portfolio through our experienced

portfolio managers

Hold your investments under supervision of a trusted custodian

| EIF | Tuesday,10 February 2026 |

Buy Price 20.7964 |

21.2344 |

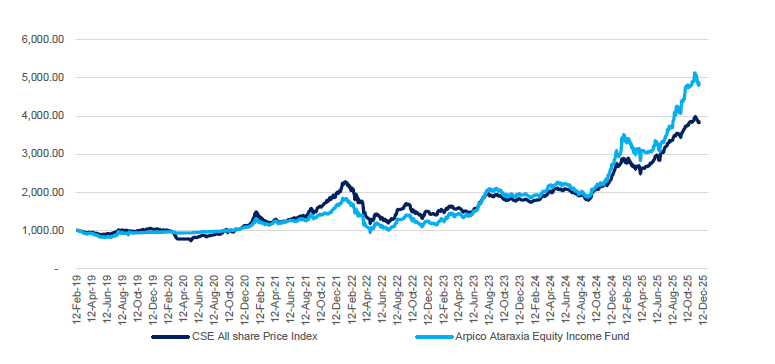

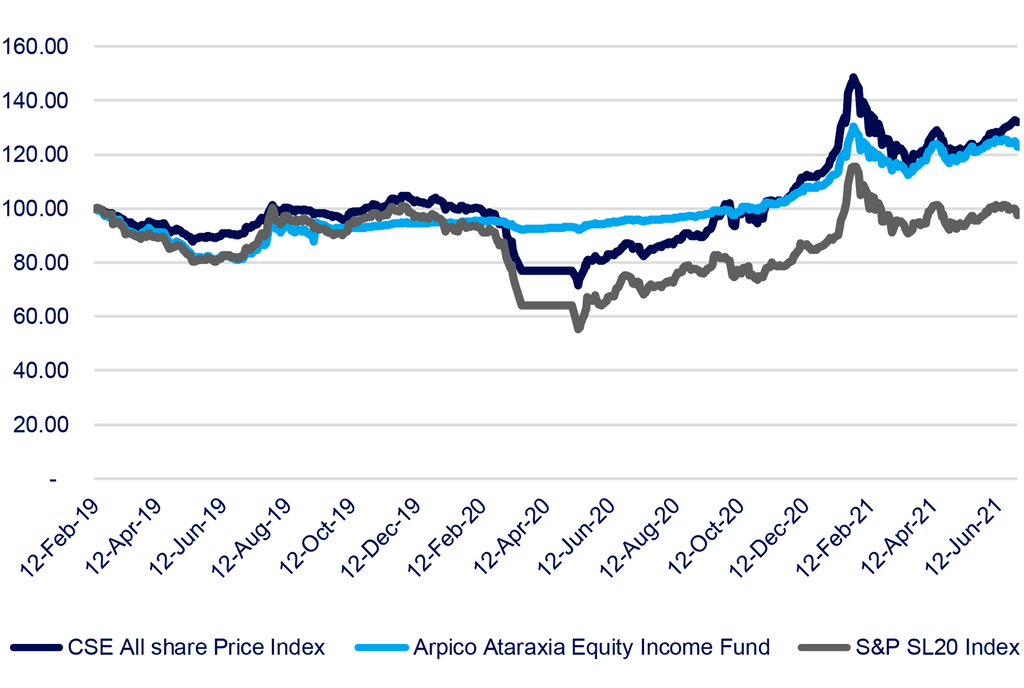

fund strategy inception (12 Feb 2019)

| 1 Mon | 3 Mon | 6 Mon | 1 Year | Since Inception | Since Inception (Anualized) |

| -4.11% | 2.61% | 40.00% | 52.41% | 362.60% | 52.64% |

|---|

Cash Management Trust Fund (CMT)

Fund Objective

The main objective of the fund is to generatereturns above the fixed deposit and bank savings rates. The fund invests in a diversified portfolio of fixed income securities.

Key Benefits

Start with a small investment as low as LKR 1,000/-

Withdraw anytime

Manage your investment portfolio through our experienced

portfolio managers

Hold your investments under supervision of a trusted custodian

| CMT | Tuesday,10 February 2026 |

Buy Price 44.4621 |

44.4621 |

| Fund Performance | 3 Mon | 6 Mon | 12 Mon | 24 Mon | Since Incept |

| Fund Return | 2.11% | 4.26% | 8.63% | 20.91% | 337.40% |

|---|---|---|---|---|---|

| Annualized Return | 8.38% | 8.45% | 8.63% | 10.44% | 25.61% |

Sri Lanka Bond Fund (SBF)

Fund Objective

The main objective of the fund is to generate secured returns from Sri Lanka Government Securities such as Sri Lanka Treasury Bonds and Treasury Bills with different maturities.

Key Benefits

Start with a small investment as low as LKR 1,000/-

Exposure to Government Securities with a small investment

Manage your investment portfolio through our experienced

portfolio managers

Hold your investments under supervision of a trusted custodian

| SBF | Tuesday,10 February 2026 |

Buy Price 0.0799 |

0.0799 |

Rates on Goverment Securities

| Treasury Bill | |||

| End Week | 91 days | 181 days | 364 days |

| 2021-08-20 | 5.33% | 5.34% | - |

| 2021-08-13 | 5.27% | 5.27% | 5.32% |

| 2021-08-06 | 5.24% | 5.24% | 5.38% |

| Treasury Bond | ||||

| End Week | 3 years | 5 years | 7 years | 10 years |

| 2021-08-20 | 6.87% | 7.47% | 8.17% | 6.87% |

USD Fixed Income Fund (USD Fund)

Fund Objective

The main objective of the fund is to provide investors with a higher yield than US treasury rates by investing in a diversified portfolio of USD denominated fixed income securities.

Key Benefits

Earn Attractive USD Returns compared to Global USD Treasury Rates

No Currency Risk

High Liquidity

Manage your investment portfolio through our experienced portfolio managers

Hold your investments under supervision of a trusted custodian

For More Details

( Fact Sheets, Explanatory Memorandum, Financials )

| Selling Price 20 | Buying Price 20 |

fund strategy inception (12 Feb 2019)

| 1 Mon | 3 Mon | 6 Mon | 1 Year | Since Inception | Since Inception (Anualized) |

| -0.8% | 5.28% | 12.85% | 28.11% | 22.86% | 9.60 |

|---|